CHIEF FINANCIAL

OFFICER’S REPORT

AEEI delivered exceptional financial results in the 2017 financial year and unlocked shareholder value through listing one of its core investments.

Chantelle Ah Sing | Chief financial officer

OVERVIEW OF THE 2017 FINANCIAL YEAR

AEEI is pleased to deliver another set of exceptional financial results after the second year of its Vision 2020 Vision. The Group continues to deliver a sterling performance due to:

- earnings growth in its core operations in the technology and health and beauty divisions;

- strong growth and returns in its strategic investments; and

- substantial increases in fair value in an associate company.

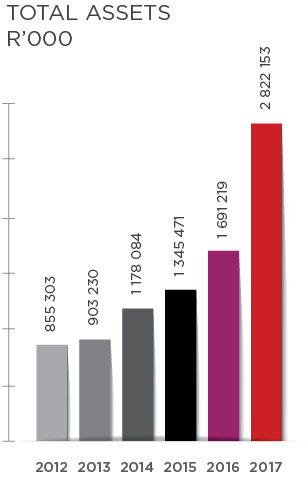

Our first strategic priority is to leverage the investment portfolio to drive growth through acquisitions. In doing so, AEEI achieved its objective to increase its diversity and geographic footprint by the acquisition of a health and beauty company and two technology companies which add value and strengthen the growth of the existing portfolio. The above-mentioned reasons positively impacted the Group by increasing the total assets by 67% to R2 822m.

In terms of investment activities, we went further by meeting our strategic objective through the successful listing of Premier Fishing and Brands Ltd and its subsidiaries on the Johannesburg Stock Exchange (JSE) in March 2017 and unlocked its value at R1,1bn.

The second strategic priority for the Group is to maintain gross margins from its underlying operations and keep Group margins within the targeted range of between 30% and 35%. The Group exceeded its margin range from an initial 34% to 38% by improving operational efficiencies through the following:

- lower catch costs and improved pricing

- vessel planning and scheduling

- change in product portfolio

- business mix in the technology and the health and beauty divisions.

Our third strategic priority is to improve social, governance and financial sustainability in our business in order to secure long-term growth and value creation for the Group. Key stakeholder relationships were harnessed through ongoing engagement to improve our governance structure, to uplift communities, to reduce our environmental footprint and to develop our transformation plan. Refer to our stakeholder engagement on building relationships with our stakeholders for further details.

We created superior value for our stakeholders through the following achievements:

- Growth in revenue of 43% from R736m to more than R1 052m

- Increase in operating profit of 111% to R655m

- Increase in total assets to over R2,8bn, in line with our strategy

- Increase in net asset value per share from 186,52c to 260,00c per share

- Interim dividend of 2c per share and a final dividend declaration of 5,50c per share

Despite an uncertain political climate and low economic growth in South Africa, the Group performed exceptionally well and operating profit increased from R310m to R655m as a result of the acquisition growth strategy in the technology division and the restructuring of the BT investment to an associate company. Most of the divisions in the Group delivered on their strategic objectives for the 2017 financial year. Refer to growth through strategic investments for more details.

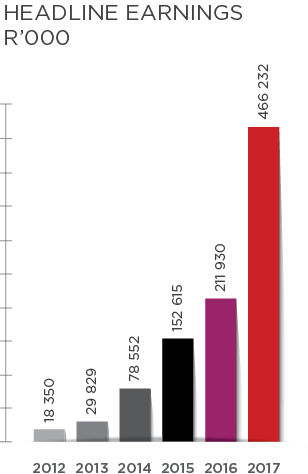

The Group’s earnings increased by 120% from R217m to R477m, which was driven by a solid operational performance from an enhanced investment portfolio and an increase in investment value from the Groups’ strategic investment portfolio. As a result of these factors, headline earnings per share swelled from 43,13c to 94,89c.

The net asset value of the Group increased from R1bn to R2bn over the year due to the corporate transactions completed and the outstanding financial performance achieved in 2017. Our performance indicator – NAV per share – increased to 260,00c per share, which is a good measure of the strength of our balance sheet.

GROUP FINANCIAL PERFORMANCE

AEEI’s revenue growth of 43% was bolstered by the R475m revenue contribution from the technology division, which increased by 182% through acquisitive growth. The fishing and brands division increased their revenue steadily to R408m from R401m. The acquisition in the health and cosmetics division increased its revenue from R4,3m to R14,9m.

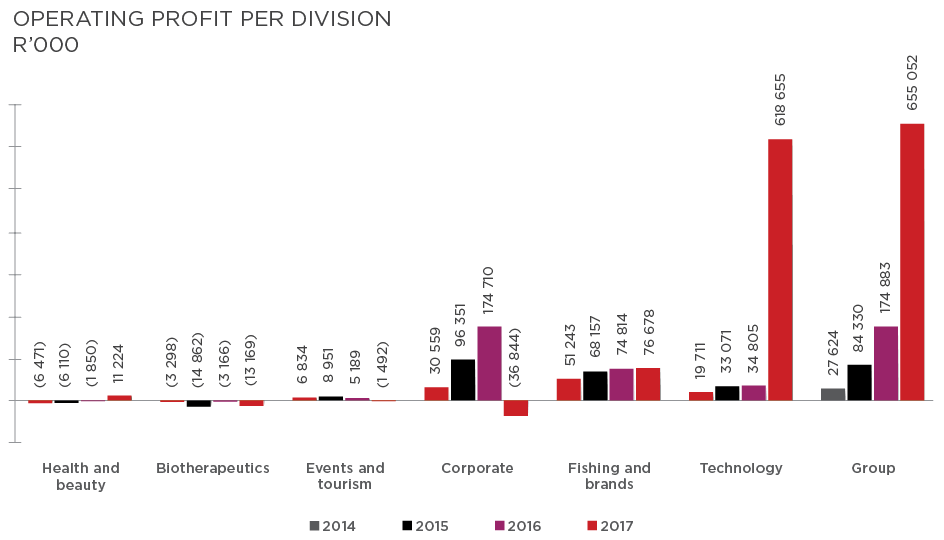

Operating profit was R655m, which is an increase of 111% over the prior year. All the operational divisions contributed positively to the growth in operating profit for the year, with the exception of the events and tourism and biotherapeutics divisions.

The fishing and brands division produced a consistent operating profit of R77m (2016: R75m) with a 19% operating margin, which was driven by improved catch costs, greater sales volumes and better pricing. The technology division increased its operating profit contribution to R619m (2016: R256m) as a result of the profit included from the two new technology and telecommunication businesses. The health and beauty division achieved R11,2m in operating profit as a result of the contribution from the cosmetics company, in comparison to a prior year loss of R1,8m.

The events and tourism division delivered lower than expected revenue and contributed an operating loss due to a loss of sponsorship income and a lower margin in the travel business under a tough economic climate. The biotherapeutics division continued with its research and development and these activities increased the Group’s operating expenses by R4m due to additional costs associated with infrastructure and resources to advance its various projects.

Operating expenses increased by R128m from R169m to R297m mainly due to a full year’s operating costs of R90m for the two newly acquired technology companies, as well as bad debt impairment of R3m, loss on disposal of assets of R2,8m and R3,9m foreign exchange losses, respectively.

The increase in the fair value adjustments of R535m is mainly due to the increased fair value of R605m from the investments in Saab and BT. As part of the restructuring of the technology division, the profit on the disposal of the Saratoga operations of R6m was included in the statement of profit of loss effective 1 July 2017, with further discontinued operations in Emergent Energy which was disposed of 1 September 2017.

Taxation amounted to R155m which included an income tax charge of R41m and deferred tax of R114m. The effective tax rate was 22.77%, mainly as a result of the effects of the capital gains and associate profit from the strategic investments.

GROUP FINANCIAL POSITION

As a result of the change in control, the investment in BT at fair value through profit and loss, previously classified under other financial assets, is treated as an investment in associate from 23 November 2016, with a deemed cost valued at R766m. A significant increase of R190m in current assets from the companies acquired and the increase of cash and cash equivalents of R560m are the major reasons for the increase in total assets.

Cash and cash equivalents increased significantly from R65m to R625m at year-end, which is largely attributable to the additional capital acquired from the listing of Premier Fishing and Brands. Current assets increased by 267% to R967m as a result of acquisitive growth in inventory and current trade and other receivables as well as cash and cash equivalents.

Total liabilities excluding the deferred tax liability increased to R573m (2016: R391m), mainly due to the additional current liabilities of the newly acquired companies, loans to minority shareholders and the outstanding amounts payable for the companies acquired during the current year.

The redeemable cumulative preference share liabilities decreased to R186m (2016: R199m) in the current year through dividend returns paid out by the strategic investments. The Group continually manages its debt commitment and finances its acquisitions through a mix of debt and equity. It decreased the medium gearing ratio to 16% (2016: 23%) with the strategic objective to reduce debt within the risk appetite limits.

The Group’s net asset value growth of 39% was driven by the strong financial performance of all the underlying existing investments as well as the impact of the newly acquired assets and liabilities. As a result of the accelerated earnings growth and strong financial position achieved during the year, the return on equity increased from 24% to 37%.

CASH FLOWS

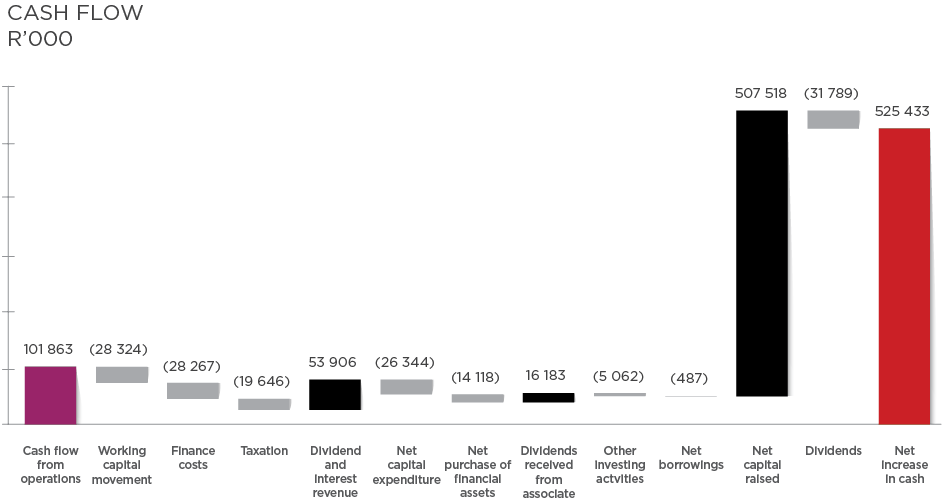

The solid operational performance from the underlying operations is reflected in the net cash flows from operating activities, which increased from R75m to R80m at year-end and included additional interest income of R20m and taxation paid of R2m. Cash generated from the operations is R73m – a decrease after a larger investment in working capital, which increased to R28m, was required by the operations. The cash raised from the fishing and brands listing is the major factor for the high balance in cash at year end. The movement in cash flows is depicted in the chart below:

MATERIAL MATTERS THAT AFFECT OUR PERFORMANCE

RESPONSIBLE USE OF CAPITAL GENERATED

The Group incurred R27m (2016: R12m) in capital expenditure which included R21m for existing operations. The fishing and brands division incurred replacement capital of R14m to maintain organic growth in its underlying businesses. The expansion plans of the abalone farm incurred expenditure of R8m in the current year to complete the live packing facility and additional infrastructure development to increase capacity on the farm.

The acquisitive growth strategy is on track in terms of Vision 2020 Vision, taking into account the two new IT companies brought into the technology division and the further bolstering of the health and beauty division through the acquisition of the cosmetics company. The strategy impacted the Group’s balance sheet by increasing its asset base through current assets and an additional R6m in long-term assets from the companies acquired. Asset efficiency ratios and pay-back periods were taken into account when these investment decisions were made and it was assessed that the returns from these investments exceeded the cost of capital.

Capital was used to fund the acquisitions through partial share issue and the cash portion was financed through a term loan and working capital facility. The Group continued to meet its existing debt obligations and strives to maintain a medium gearing of 15% to 25%.

INVESTMENT IN BUSINESS OPERATIONS

The technology division via its health information systems, is further developing its own software to improve the ambulance system with a programme to assess the availability of beds at public hospitals. In the current year, R1,1m was expended to develop this critical service to implement in the Western Cape’s government hospitals next year. Further development of the electronic continuity care record system enabled a second roll-out in October 2016.

Distribution rights valued at R44,8m were acquired through a business combination in the health and beauty division for contracts with four key principals with exclusive brands – Gatineau, NUXE, RVB SKINLAB/diego dalla palma professional and Sothys, as well as the rights to regulate the purchase of Plantronics products for resale in the technology division.

Magic 828 is the fourth largest commercial radio station in listenership in the Western Cape according to an independent survey. After two years on air, the station grew its listenership to more than 340 000 listeners and further working capital was invested to obtain tangible returns in the short to medium term.

Working capital was provided to the biotechnology division to continue with research and development activities by expanding the dendritic cell vaccine project to include pre-clinical trials for extreme drug resistant tuberculosis and the pursuit of MCC approval to commence with Phase 1 clinical trials on breast cancer as well as to improve its Repotin production methodology.

GROWTH THROUGH STRATEGIC INVESTMENTS

The Group’s strategic investment in Saab continues to grow in value, delivering strong financial results with sustainable dividends to repay the preference share liabilities. The measure of control over the investment in BT changed to significant influence and is now equity accounted as an investment in associate. Our share of the carrying value of the investment in associate is accounted for at R781m.

The Pioneer Foods Group continued to experience a year of share price volatility. The Group expects a recovery in this investment in the medium to long term and continues to hold this listed investment for the long term. The number of shares in Sygnia increased during the year from 1.19m to 2.68m, by participating in a rights issue increasing our shareholding to 1.735%.

The synergistic benefits between AEEI and its key strategic partners continue to improve and expand the investment portfolio, enabling long-term growth and value creation.

EXTERNAL FACTORS THAT IMPACT THE GROUP’S PERFORMANCE

Factors outside of our control, which include higher fuel prices, volatile exchange rates, increasing electricity prices and changing interest costs, meant that management constantly had to relook at operations and resources within our control.

The Group’s cost structure and margins are managed by the executive operational management teams, which are reported on through the governance structures. Key decisions are taken to ensure that the Group’s cost structure and margins do not materially affect AEEI’s budget expectations or strategic plans.

The volatility of the exchange rates impacted the various businesses both positively and negatively during the year. Operational management responded by improving their operational efficiencies by renegotiating pricing and improving cost structures to reduce the overall impact on their profits. A net foreign exchange loss of R 3,9m (2016: R1,6m) impacted the 2017 financial results.

The current slow economic climate and political instability in the South African economy necessitated that the Group open itself up to exploring opportunities outside of South Africa. The Group continued to invest in parts of Africa in accordance with the strategic plans in our technology division to expand the demand for their product offering.

The adverse weather conditions impacted the number of seaworthy days and catch rates in the fishing and brands division and this led to changing the vessel planning and scheduling. Due to the diversification strategy, operational management were able to mitigate any material effects. The declining demand from the drought-stricken farming areas in the Western Cape negatively impacted revenue and operating profits in the health and beauty division. Management expanded its product offering to other less severely drought-affected farming regions in the Northern and Eastern Cape to counter the effects in the Western Cape.

SHAREHOLDER RETURNS

AEEI returns value to its shareholders in the form of dividends and share price appreciation. The share price traded well with a closing price of 350c and we expect this to increase further as the Group meets its strategic objectives.

We continue to reward our shareholders in line with our earnings growth and accordingly increased our total gross dividend per share to 7,50 cents per share, a 127% increase from the prior year’s 3,30 cents per share. The Board declared a final gross dividend of 5,50 cents per share on 7 November 2017.

LOOKING AHEAD

In 2017, the medium-term economic outlook for South Africa remains constrained as growth remains at 0.3% and poor business confidence persists. AEEI’s sustainable foundation, which is built on a diversified investment portfolio, cash-generative businesses and an efficient and effective business model, enabled resilience under the current conditions and creates the ability to focus on achieving its Vision 2020 Vision strategy.

AEEI will continue to diversify through acquisitive growth by raising capital through equity markets and/or increasing debt. The Group’s balance sheet remains strong with sufficient leverage to enable the financing of further acquisitions.

AEEI’s financial objective remains to create superior value for its stakeholders and maintain gross margins within its targeted range by continually improving the cost structure and operating efficiencies, to overcome the external factors that are out of our control.

APPRECIATION

I would like to thank the financial teams across the Group for their diligence, dedication and commitment during a turbulent year. We have come through with determination and integrity to meet the demand of delivering quality financial information to our stakeholders.

We acknowledge the unwavering support and guidance from our Board of directors and executive management teams that levered our efforts to deliver on our Vision 2020 Vision strategy.

CONCLUSION

I am pleased to report that the Group’s financial objective – to deliver superior value to our shareholders – was achieved through the delivery of an exceptional set of financial results and a strong balance sheet for the year. We believe that the year ahead will bring deeper fulfilment of the Vision 2020 Vision and build a greater tomorrow for the Group.

Chantelle Ah Sing

Chief financial officer

GREAT LEADERS

DON’T SET OUT TO

BE A LEADER…

THEY SET OUT TO

MAKE A DIFFERENCE.

IT’S NEVER ABOUT

THE ROLE – ALWAYS

ABOUT THE GOAL.

Lisa Haisha