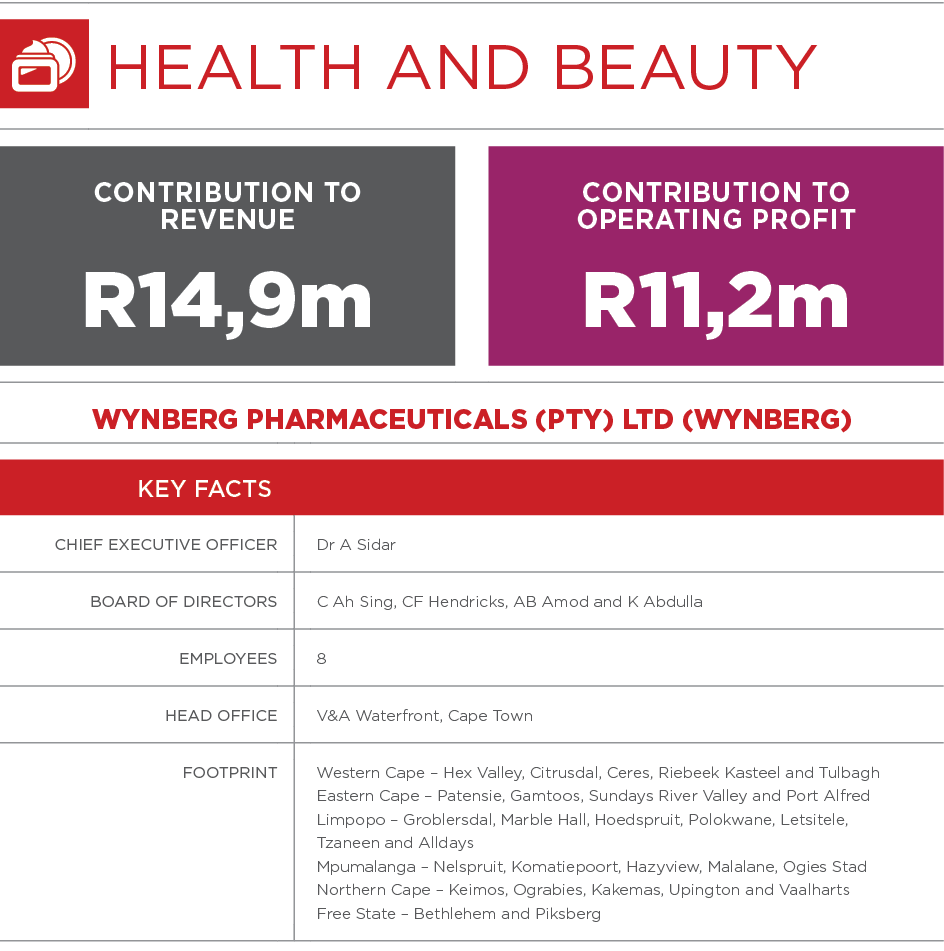

PROFILE

Wynberg Pharmaceuticals supplies an extensive range of locally manufactured, natural products, that are human, animal and plant safe, internationally recognised and certified as such, using British Standards European Standards (BS ES), United Kingdom and National Regulatory Compulsory Specifications (NRCS) South Africa, as well as the Department of Agriculture, Forestry and Fishing (DAFF) certification and registrations throughout South Africa.

The products are registered and manufactured locally and are being used with success in the agricultural, food and general health and hygiene sectors. The Company signed a licensing and joint venture agreement with a UK-based company to manufacture and market an extensive and totally natural range of hygiene and sanitation products into the health care, food and agricultural pre-harvest spray programmes and post-harvest packhouse processing sectors. This range of products, known locally as Plant Nutrient Synergist (PNS), ViBacSan Hygiene and Sanitation, is manufactured and marketed through the Company.

2017 OPERATIONAL PERFORMANCE

The Company expanded its market share to other regions after three years of research and development as well as the registration of products. The overall performance is below budget largely due to the drought which has had a severe impact for the past two years. Increased marketing initiatives in the Eastern Cape and northern regions of South Africa resulted in a significant uptake.

Diversification into the food and beverage as well as non-agricultural sectors is critical to avoid the risks of the drought and the cyclical nature of the agricultural market. This is largely mitigated by the current research and development projects underway in the food sector.

VISION 2020 VISION – WYNBERG’S CONTRIBUTION

Following the strategic planning session held in 2015 which entailed an analysis of the business with the primary objective of having focused and aligned efforts across the business to deliver on its long-term goals, a five-year strategic plan to the year 2020 was implemented. The strategic plan has clear deliverables, strategic actions for each strategic lever as well as detailing clear time frames.

The following was achieved during 2017:

- The team has taken research initiatives to commercialisation products into the agricultural sector.

- The introduction and successful registration of additional products to the original 15 products in the ViBacSan range have been subject to independent evaluation and trials.

- The introduction of pre-harvest products to the local market has been extremely successful providing farmers with opportunities to meet international standards on food safety in the export of fruit and vegetables.

- The post-harvest products will add to the value chain in the agricultural sector. These are part of the products mentioned above and are used in the process following harvest and picking. Packhouses are the primary customer and a distribution agreement has been signed with a company to promote to the farms and packhouses nationally. It has been accepted in various regions and also tested and accepted by the Citrus Research Institute (CRI), which now gives it credibility to be marketed into new areas.

- Growth in the food and beverage sector is still in the research and development phase with pilot projects with bread manufacturers and other fresh product producers to extend shelf life. They have now strategised and budgeted for this in the new budget.

PROSPECTS AND FUTURE OUTLOOK

The Company developed a platform for growth which is estimated at 25% per annum based on the uptake of the product offering over the next three years. There are no planned acquisitions in the short to medium-term and organic growth is expected by increasing market share and penetration into both the pre- and post-harvest markets.

The main opportunity that exists is the international focus of a green economy and protecting the environment as they have acquired the rights to internationally recognised natural products supporting key industries that impact on the health and well-being of the population as a whole, ranging from domestic hygiene to food security.

The following prospects have been identified in reaching their Vision 2020 Vision:

- Growth of product portfolio in the food and beverage industry – the opportunities to capitalise on their empowered status and successfully attract international and local partners to expand their product portfolio.

- A joint venture is currently under negotiation which will bring new technology and innovative products into the South African economy with cost-effective improvements in food shelf life and quality.

- The food and beverage manufacturing and processing market sector has been planned for 2018 while the previous years’ focus was predominantly on the agricultural sector.

- Conclude a joint venture local manufacturing agreement with a UK based company – this initiative will provide local jobs and require the transfer of new skills to staff.

- Product and market diversity – the diversity of their portfolio and their strategy to manufacture using local companies support the changes to the tender process, which has an increased preference for local suppliers and manufacturers.

- Expansion into new sectors with innovative products – a significant opportunity exists to capture a large portion of the infection control and hygiene and sanitation markets in the health delivery system; and the food processing and hospitality sectors with their internationally recognised, completely natural range of sanitation and hygiene products.

- Retention of business won – in a business environment that is based on a high level of relationship building, the successful retention of business won on this basis is a key measure of their performance.

- Expand into new markets outside of South Africa.

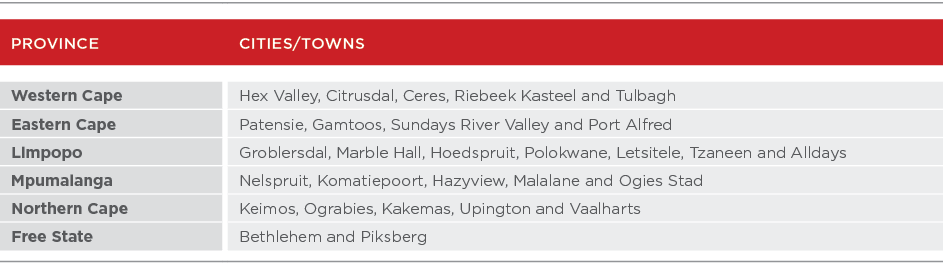

OPERATIONAL FOOTPRINT

Wynberg’s administrative function operates from the V&A Waterfront, Cape Town.

Operational footprint of products

PRODUCTS/BRANDS

Detailed information about Wynberg’s business model, stakeholders, risks and governance is available on the website at www.aeei.co.za.

PROFILE

Orleans Cosmetics (Pty) Ltd was recently acquired and became a subsidiary of AEEI in May 2017. It was a business previously known as Orleans Distributors CC and RVB Cosmetics CC, which has been in business in South Africa for the past 21 years.

Orleans Cosmetics imports and distributes four cosmetic brands from Europe on an exclusive basis in South Africa and neighbouring territories, through retailers and beauty salons.

Orleans Cosmetics is the exclusive Southern Africa distributor of the following imported cosmetic brands, each one with a long international history:

- Gatineau – founded in France 82 years ago;

- NUXE – founded in France 25 years ago;

- RVB SKINLAB/diego dalla palma professional – founded in Italy 56 years ago; and

- Sothys – founded in France 71 years ago.

Gatineau and NUXE are sold in retail groups such as Truworths and Woolworths, while Gatineau is sold in Dischem with both brands being sold in beauty salons and spas.

RVB SKINLAB/diego dalla palma professional and Sothys are exclusively found in beauty salons and spas across the country.

The Company’s present focus is on skin care with a particular emphasis on anti-ageing. The business has a make-up range in RVB SKINLAB/diego dalla palma professional.

2017 OPERATIONAL PERFORMANCE

Orleans Cosmetics was acquired in May 2017; hence only three months can be accounted for in terms of operational performance. For the three-month period ended 31 August 2017, revenue is expected R9,6m with net profit after tax of R0,6m.

VISION 2020 VISION – ORLEANS COSMETICS’ CONTRIBUTION

Orleans Cosmetics’ vision is to be a leading player in the prestige and masstige cosmetics industry in both the retailing industry and in beauty salons. It intends to acquire fragrance lines and additional make-up brands in order to complement its current skincare ranges.

PROSPECTS AND FUTURE OUTLOOK

The CEO of Orleans Cosmetics has a vast amount of experience in this industry, having worked with major brands for many years. As a result, he understands the industry very well and is well placed to drive the future growth of the business.

The key drivers in the business are the following:

- Superb customer service at point of sale through their dedicated, highly trained beauty consultants and the qualified beauty therapists employed by the salons

- Training of store consultants and beauty salon therapists

- Close strategic relationships with the key retailers

- Excellent management at head office and in the field, being the area managers

- Public relations and marketing

Outlook for 2018

- Focus on strengthening the brand’s presence in the market place

- Explore the possibility of obtaining additional agencies in fragrance and in make-up

The Company intends doubling the size of the business within the next four to five years. Growth will occur through a balance of organic growth and through acquisitions.

The intention is to retain the entrepreneurial spirit which already exists and to blend this with the business expertise which AEEI can provide. The Company has built a solid reputation over the years as being professional, well managed and responsive to the needs of its end customers and to the retailers and beauty salons.

As a subsidiary of AEEI, Orleans Cosmetics is very well positioned to be the partner of choice for both local companies and to represent overseas brands due to AEEI’s B-BBEE credentials.

Industry statistics indicate that the luxury and masstige segments of the cosmetics market are considered to be in excess of R6bn per annum at retail prices and there is enormous potential growth for Orleans Cosmetics.

OPERATIONAL FOOTPRINT

The Company has the exclusive distribution rights from the four overseas-based principals for South Africa and Namibia and in certain cases it also has the exclusive rights to Mauritius, Madagascar, Zimbabwe, Swaziland, Botswana and Lesotho.

PRODUCTS/BRANDS

The Company is the exclusive South African and Southern Africa distributor of the Gatineau, NUXE, RVB SKINLAB/diego dalla palma professional and Sothys brands.

Detailed information about Orleans Cosmetics’ business model, stakeholders, risks and governance is available on the website at www.aeei.co.za.