“Society as a whole benefits immeasurably from a climate in which all persons, regardless of race or gender, may have the opportunity to earn respect, responsibility, advancement and remuneration based on ability.”

REMUNERATION REPORT

Statement from the chairman of the remuneration committee

– Mr Salim Young

I am pleased to present AEEI’s 2017 summarised remuneration report on behalf of the remuneration committee.

Reporting and disclosures are evolving to ensure that stakeholders are able to understand how remuneration decisions are made in order to assess the outcome of these decisions. Shareholder focus remains on ensuring pay for performance and alignment with shareholder goals and enhanced disclosure so that shareholders can understand the quantum, rationale and drivers of executive remuneration.

In South Africa, good governance, ethics and leadership regarding remuneration is primarily informed by King IVTM. This report highlights the key components of our policy and how these align to our performance and strategic objectives for the 2017 financial year.

The committee was tasked by the Board to approve and oversee the implementation of the remuneration policy enabling it to achieve the Group’s strategic objectives, translating into market-related yet affordable performance-linked rewards and to ensure balanced and transparent outcomes that align with shareholder interests over the short and long-term. Ultimately our policy enables the attraction and retention of valuable talent.

Remuneration and reward systems remain sensitive matters, especially in the socio-political environment. Our approach to remuneration aligns to our ethics, corporate governance philosophy and shared values – respect and trust, people, integrity, accountability, stakeholders, commitment and investment. During the past year, we introduced a few non-material changes to the remuneration policy, strategy and associated practices in alignment with best practices, but have kept our core remuneration policy and principles consistent. We will continue to review and adapt to changes in market conditions to ensure that our policy and principles remain appropriately aligned with our overall business strategy.

Executive remuneration and the governance of remuneration continues to remain a feature of the corporate governance landscape while the issue of income differentials and the steps necessary to address these continued to enjoy prominence in the local and international market. It is fundamental to our core remuneration principles that executive remuneration is aligned to the Group’s performance. Income differentials are an important topic within the Group and the remuneration committee remains committed to monitoring and addressing this critical issue.

The alignment of our executives’ remuneration to the long-term strategic goals of the Group to deliver sustainable value to shareholders and building the business remained a key focus during the year. Some decisions and their related impact in setting targets in terms of performance-related remuneration were made for the executive and senior management of the Group. Weightings of performance as well as specific financial targets were reviewed and amended accordingly for the year under review. The committee was satisfied and will continue to monitor remuneration against the appropriate strategic objectives, performance and market benchmarks.

The committee had an independent third party perform a market comparison against our peers in other businesses. The comparison was used to determine where we should remunerate. The committee reviewed the targets set in terms of performance-related remuneration for the CEO, the executive management team and senior management in the Group which include individual performance factors and a combination of portfolio-specific targets. The CEO and executive management team’s performance are assessed against a set of predetermined objectives that include, inter alia, strategic leadership, execution of the strategy through business results and stakeholder relations. The Board recognises that the successful delivery of the Group’s objectives should constitute both financial and non-financial performance measures, with the key financial measures which include profits, cash flow and asset growth weighted to 70% and the remaining 30% weighted to non-financial measures for most of the executives in the Group.

The committee remains mindful to ensure overall remuneration was appropriate for the performance of the Group and in relation to its operational peers. In doing so, the committee considered the overall risk environment, its risk appetite and risk profile and the need to attract, retain and motivate key talent to enable the delivery of the Group’s strategic objectives.

During the financial year, the remuneration committee received guidance from the following independent advisors:

- An external advisor

- PE Corporate Services – executive salary benchmarking and job grading

The committee conducted a detailed review of each of the three senior executive’s performance for the 2017 financial year and recommended to the Board that a bonus be paid using the Matrix guidelines based on financial and qualitative performance. The committee agreed to recommend to the Board the approval of a general salary increase based on the current price index of 7% for all employees in the Group.

We remain committed to closing the wage gap and pay particular attention to those at the lower end of the earnings spectrum and consistently applied the principle that our remuneration should be fair and competitive and should reflect the performance of the business and the business units.

Our ethos is one of appreciation for commitment, diligence, care and attention to detail. We respect and recognise our employees for their contribution made during the year and inspire them to realise their full potential and we believe in rewarding accordingly.

This report is part of the remuneration report and will be put to a non-binding advisory vote by shareholders at the upcoming AGM. It summarises the Company’s remuneration policy for non-executive directors, executive directors and prescribed officers. The information provided in this report has been approved by the Board on the recommendation of the remuneration committee.

For the year under review, the committee is satisfied that is has fulfilled all its statutory duties assigned by the Board.

S Young

Chairman of the remuneration committee

(King IVTM – Principles 13 and 14)

ROLE OF THE REMUNERATION COMMITTEE

The remuneration committee’s main purpose is to implement the guiding principles in the application of remuneration governance, practices and policies and to ensure that the Group remunerates fairly, responsibly and transparently so as to promote the achievement of the strategic objectives and positive outcomes in the short, medium and long-term.

REMUNERATION POLICY

INTRODUCTION

The AEEI Group’s remuneration committee is primarily responsible for overseeing the remuneration and incentives of the Group’s executive directors and key management, as well as providing strategic guidance.

To assist in the achievement of AEEI’s long-term strategic goals, the remuneration committee has put a formal remuneration policy in place. Each major subsidiary has its own remuneration committee and a policy specific to its business unit, including the industry in which it operates taking into account AEEI’s long-term strategic goals.

The main aim of the committee is to assist the Board in fulfilling its responsibilities in establishing formal and transparent policies and guiding principles of a standardised approach in the application of remuneration practices within all the business units and functions.

The remuneration committee’s main purpose is to implement the guiding principles in the application of remuneration governance, practices and policies and to ensure that the Group remunerates fairly, responsibly and transparently so as to promote the achievement of the strategic objectives and positive outcomes in the short, medium and long-term.

OVERVIEW OF THE MAIN PROVISIONS OF THE REMUNERATION POLICY

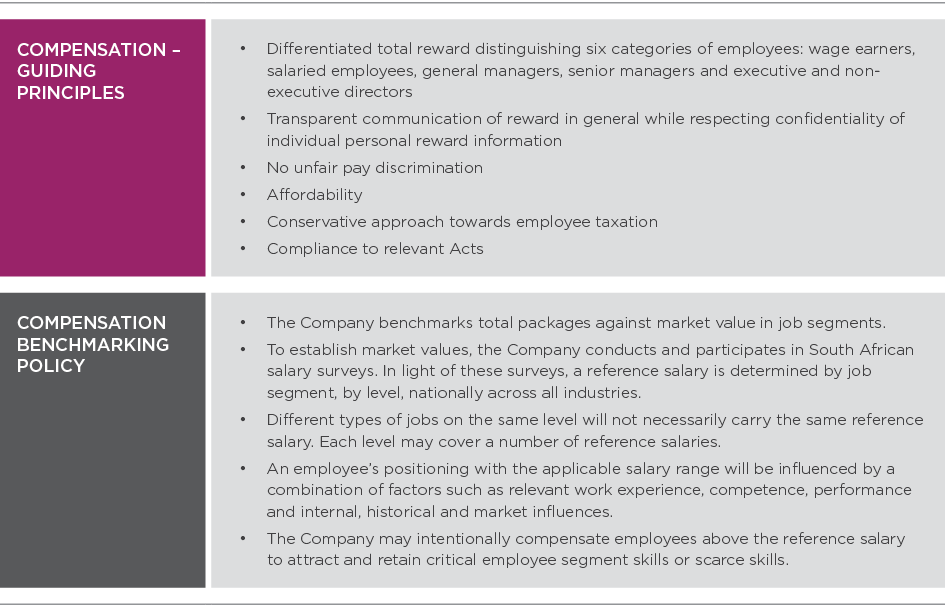

The remuneration policy is aimed at aligning remuneration practices that will enable the committee to achieve the Group’s strategic objectives, translating into market-related yet affordable performance-linked rewards and to ensure balanced and transparent outcomes that align with shareholder interests over the short and long-term and ultimately enable the attraction and retention of valuable talent. Our approach to remuneration aligns to our ethics, corporate governance philosophy, shared values and best practices.

The remuneration policy is designed to achieve the following strategic objectives:

- Support the attainment of AEEI’s strategic business objectives and strategies

- To attract, retain and motivate key and talented individuals

- Compete in the market place to be an employer of choice

- Reward individual, team and business performance and encourage superior performance

- Support the key values of AEEI

- To promote the achievement of the Group’s strategic objectives within the organisation’s risk appetite

- To promote positive outcomes

- To promote an ethical culture and responsible corporate citizenship

The remuneration policy addresses the organisation’s remuneration and includes provision for the following:

- Arrangements towards ensuring that the remuneration of executive management is fair and responsible in the context of overall employee remuneration in the organisation.

- The use of performance measures that support positive outcomes across the economic, social and environmental context in which the organisation operates and all the capitals that the organisation uses or affects.

- Enable the Company to attract, engage and retain talent to drive performance and to meet the strategic objectives of the Company.

EXECUTIVES AND EMPLOYEES

The remuneration of the executives is reviewed annually by the remuneration committee, which seeks to ensure that balance is maintained between the fixed (base salary) and variable (discretionary bonus) elements of remuneration, as well as between short-term (base salary and discretionary bonus) and the long-term financial performance objectives of the Group.

Cost-to-company remuneration incorporates the following elements:

Base salary

Base salary is guaranteed annual pay on a cost-to-company basis. It is subject to annual review and adjustments are effective 1 September of each year, coinciding with the commencement of the Group’s financial year. Benchmarking is performed with reference to companies comparable in size, industry, business complexity and the level of responsibility that the individual assumes.

Benefits

Benefits form part of the total cost-to-company and include:

- membership to the pension/provident fund (providing death, disability and dread disease benefits);

- medical aid;

- unemployment insurance fund; and

- funeral cover.

COMPLIANCE

The remuneration policy is reviewed each year to ensure that the remuneration framework remains effective in supporting the achievement of the Company’s business objectives and remains in line with the best practice. AEEI complied with the remuneration policy, relevant remuneration governance codes and statutes. The recommended practice as stated under Principle 14 of King IVTM has been applied and is explained throughout this report through the outcomes achieved.

During the year, the committee engaged the services of an independent external advisor in support of our endeavours to act independently and provide specialist input.

EXECUTIVE DIRECTORS’ SERVICE CONTRACTS

Executive directors do not have fixed-term contracts but have permanent employment agreements with the Company. The remuneration of executives is determined on a cost-to-company basis and is subject to an annual review by the remuneration committee. Provident or pension fund and health care provision form part of the overall cost-to-company packages. Executive directors are members of the Group’s provident fund and are required to retire from the Group as a director of the Board at the age of 65, unless requested by the Board to extend their term. There are no other special benefits for executive directors.

PUBLIC OFFICER

The public officer, Mr Khalid Abdulla is not remunerated for his role as the public officer of the Company.

PERFORMANCE APPRAISALS

Performance appraisals of the executive management team are done by the committee on an annual basis. Line managers and divisional managers also conducted performance appraisals on staff in the Group. The CEO conducted the performance appraisals of the divisional heads in the Group and provided feedback to the committee.

NON-EXECUTIVE DIRECTORS’ REMUNERATION

The non-executive directors receive fees for serving on the Board and Board committees. The fees for non-executive directors are reviewed annually by AEEI’s executive committee and thereafter to the remuneration committee, which seeks to ensure that fees are market-related and presented to shareholders for approval. The Board recommends the fees to shareholders for approval at the annual general meeting of the Company. Consideration is given to the relative contribution of each non-executive director and their participation in the activities of the Board and its committees. Changes to the fee structure are effective 1 September, subject to the approval by shareholders at AEEI’s annual general meeting held in February of each year. The annual fees payable to non-executive directors are, as in the past, fixed and not subject to the attendance of meetings. In the event of non-attendance on a regular basis, same may be reviewed.

EXECUTIVE AND NON-EXECUTIVE Directors’ REMUNERATION

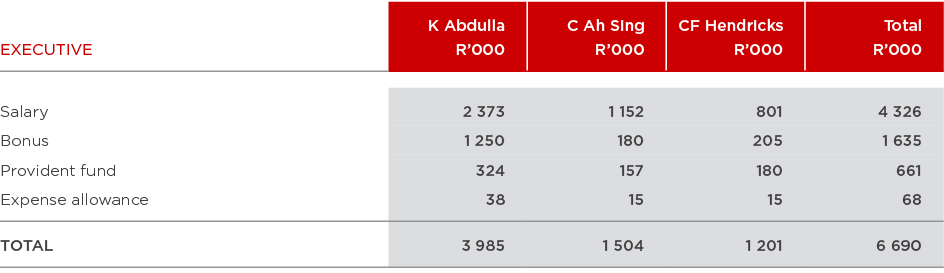

The 2017 remuneration of the executive directors is set out in the table below:

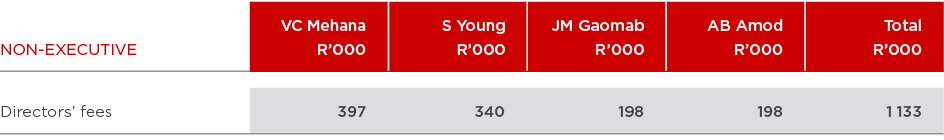

The 2017 remuneration of the non-executive directors is set out in the table below:

Mr TT Hove and Ms Z Barends waived their non-executive fees.

AEEI covers all reasonable travelling and accommodation expenses incurred to attend Board and committee meetings.

Non-executive directors do not have any employment contracts, nor do they receive any benefits associated with permanent employment

NON-BINDING ADVISORY VOTES ON THE REMUNERATION POLICY AND IMPLEMENTATION REPORT

In the event that less than 75% support for the above-mentioned reports are achieved at the annual general meeting, the Board will invite dissenting shareholders to send reasons for such votes in writing, whereafter further engagements may be scheduled to appropriately address legitimate and reasonable objections and concerns raised.

IMPLEMENTATION REPORT

This part of the report focuses on the performance outcomes against the targets set for 2017.

Salary increment

The committee reviewed the targets set in terms of performance-related remuneration for the CEO, executive management team and senior management in the Group which includes individual performance factors and a combination of portfolio-specific targets.

For the year ended 31 August 2017, a general salary increase was approved based on the yearly average current price index of 7% for all employees in the Group.

Discretionary bonus

For the year ended 31 August 2017, the discretionary bonus was calculated as a percentage of the qualifying executive/senior management/employee’s base salary according to seniority and the level of responsibility assumed. Qualifying executives and senior management received a discretionary cash bonus dependent on meeting both financial and qualitative strategic performance objectives. Employees received a discretionary cash bonus dependent on meeting both personal and the Company’s strategic objectives. Financial, qualitative, personal and Company strategic performance are aimed at ensuring sustainable long-term value creation to the benefit of all stakeholders. The total base salary and bonus paid were considered to be fair to the Company and the executive/senior manager/employee.

For the year ended 31 August 2017, the CEO and executive management team’s performance was assessed against a set of predetermined objectives that include, inter alia, strategic leadership, execution of the strategy through business results and stakeholder relations. The successful delivery of the Group’s objectives constitute both financial and non-financial performance measures, with the key financial measures which include profits, cash flow and asset growth weighted to 70% and the remaining 30% weighted to non-financial measures for most of the executives in the Group.

The committee remains mindful of ensuring that overall remuneration was appropriate for the performance of the Group and in relation to its operational peers. In doing so, the committee considered the overall risk environment, its risk appetite and risk profile and the need to attract, retain and motivate key talent to enable the delivery of the Group’s strategic objectives.

(King IVTM – Principle 14)

A copy of the full remuneration policy is available on www.aeei.co.za.

SUCCESSION PLANNING

The Board recognises its responsibility to make provisions for competent leadership for the Group. In fulfilling this responsibility, the Board also acknowledges that situations may arise which require a need for interim leadership and that future leadership transitions are inevitable.

The purpose of succession planning is to ensure that plans are in place to develop potentially suitable candidates for the future. The focus also remains on the retention of key and critical skills in the Group. Succession planning is reviewed periodically and provides for both succession in emergency situations and succession over the longer term.

The succession plan is designed to address each of the following situations:

- Provision for leadership during anticipated or unanticipated short-term absences of the CEO

- Planned resignation – in the event of a permanent leadership change, the process for conducting a CEO search

- Provision for leadership during anticipated or unanticipated short-term absences of the chair

- Planned resignation – in the event of a permanent leadership change, the process for conducting a chair search.